Source: © pikist.com

During pandemic, Japanese investors shy away from Bitcoin, cryptocurrencies and save cash

- Tags:

- bitcoin / coronavirus / COVID-19 / cryptocurrency

Related Article

-

Cooled Masks Sold in This Vending Machine Turn Out to Be a Hit

-

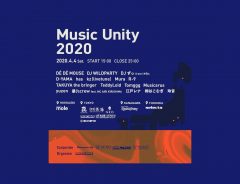

Japanese music venues struggling in pandemic launch live streaming festival Music Unity 2020

-

Telework in the great outdoors with camping car rental service Caravan Work

-

Tokyo Disneyland Hotel staff displays heartwarming hospitality by surprising a guest during coronavirus closure

-

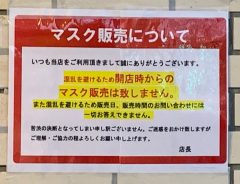

Japanese drugstore commended for sign posted, mask-selling policy

-

Mount Fuji Under Lockdown: Trail Closures

Japan appears poised for hard times. Exports have plummeted and job losses and pay cuts are a haunting specter. Domestic demand, slammed late last year by a tax hike, remains timid as a government discount campaign intended to spur spending has been met with limited consumer interest. To cover a shortfall in tax revenues, the debt-laden government recently issued more bonds.

Fortunately, Japanese households are renown savers. Despite a gray population drawing on funds for retirement, the household savings rate has strengthened in recent years. This trend could likely compound as consumers tighten purse strings further in response to the pandemic.

It seems households are “flushed with cashed”—to trade in hyperbole. While household bond and equity holdings are experiencing an uptrend, most savings are held in cash and deposits. To be precise, collective bond holdings comprise 26 trillion JPY ($240 billion), while cash and deposits account for an eye-popping 1 quadrillion JPY ($9.36 trillion). Equities comprise 11.1 of Japanese portfolios, compared to about 20 percent in America.

A Bullish 2017

In 2017, Japan experienced a wave of hype centered upon cryptocurrencies like Bitcoin. Like much of Asia, consumers invested heavily in the space. Advertisements were ubiquitous and retail investors poured into the speculative digital asset. By January of 2018, 56.2 percent of bitcoin trading occurred in yen.

Throughout 2017, the price of the digital asset increased from roughly $800 to $20,000. Legal clarity likely played a pivotal role in increasing adoption among Japanese nationals. The Virtual Currency Act designated digital assets as a form of payment method but not legally-recognized currency. Furthermore, it exempted virtual currencies from the consumption tax and taxed capital gains as miscellaneous income. The Japan Financial Services also began licensing and regulating institutions during the run-up.

The chief financial officer of Japan's largest cryptocurrency exchange Midori Kanemitsu attributed the success of the space to proper regulation. In early 2018, she told The Japan Times, "Effectively, Japan is the first and only country that has a proper legal system regulating cryptocurrency trading. That's a big deal. Before the law regulating cryptocurrencies, people worried about what would happen to their money if an exchange were to go bust." Given younger consumers' risk aversion, she was likely correct in saying so.

Uncertain Times

So, what are the attitudes of Japanese speculators towards digital assets during such uncertain economic times? Personally, I can recall the virality of excitement during the 2017 run-up, and the pervasive sense of buyer's remorse during the crash that followed.

A recent article on cointelegraph.com, suggests that sentiment hasn’t changed. According to the media resource, 100,000 JPY ($930) stimulus checks issued throughout the spring and summer were not deposited into major cryptocurrency exchanges. American exchanges, on the other hand, experienced a sharp rise in $1,200 deposits following the issuance of stimulus checks of the same amount. Rather, cash and cash-like instruments rose 5.9 percent in June, suggesting Japanese consumers were depositing their checks and not investing.

Panicky investors were also seemingly quick to sell during a March pull down which saw the Nikkei fall 10 percent and Bitcoin’s price plummet from about $8,600 to $5,000. User’s flooded exchanges with digital assets at that time, a situation thought to be indicative of sell pressure. This negative sentiment was underlined by regulators' announcements downplaying the possibility of cryptocurrency ETFs and hawkish comments concerning the speculative nature of digital assets.

A Safe Haven

Unsurprisingly, it appears risk-averse households are keeping cash on hand. The Japanese economy is likely to face a difficult recovery, and a burdensome governmental debt will make it difficult for officials to provide fiscal relief.

More importantly, however, Japan's economy is notoriously deflationary. Despite the Bank of Japan's perpetual 2 percent inflation target, the economy is likely to contract. According to a Reuters poll of analysts, deflationary trends will continue and core consumer prices are expected to fall by 0.3 percent. The situation will likely require central bank stimulus.

Related to deflationary pressures, the Japanese yen's recent "rapid" rise has concerned Minister of Finance Taro Aso and others. Japan's GDP is tightly tied to exports, which have plummeted throughout the pandemic as the US and others have rolled back imports. The problem is compounded by an appreciating yen, which makes Japanese goods more expensive and less competitive.

While this situation implies higher purchasing power for yen-flushed consumers, it is not without caution. In the past, the Japanese government has weakened its currency to boost exports. Japan's current debt stands at 236 percent of GDP, limiting officials' ability to spend their way out of the problem. Falling tax revenues are also straining governmental balance sheets. Consumers should keep a close eye on monetary policy and be wary of changes that may affect the purchasing power of their savings.